Real Estate Investment Trusts

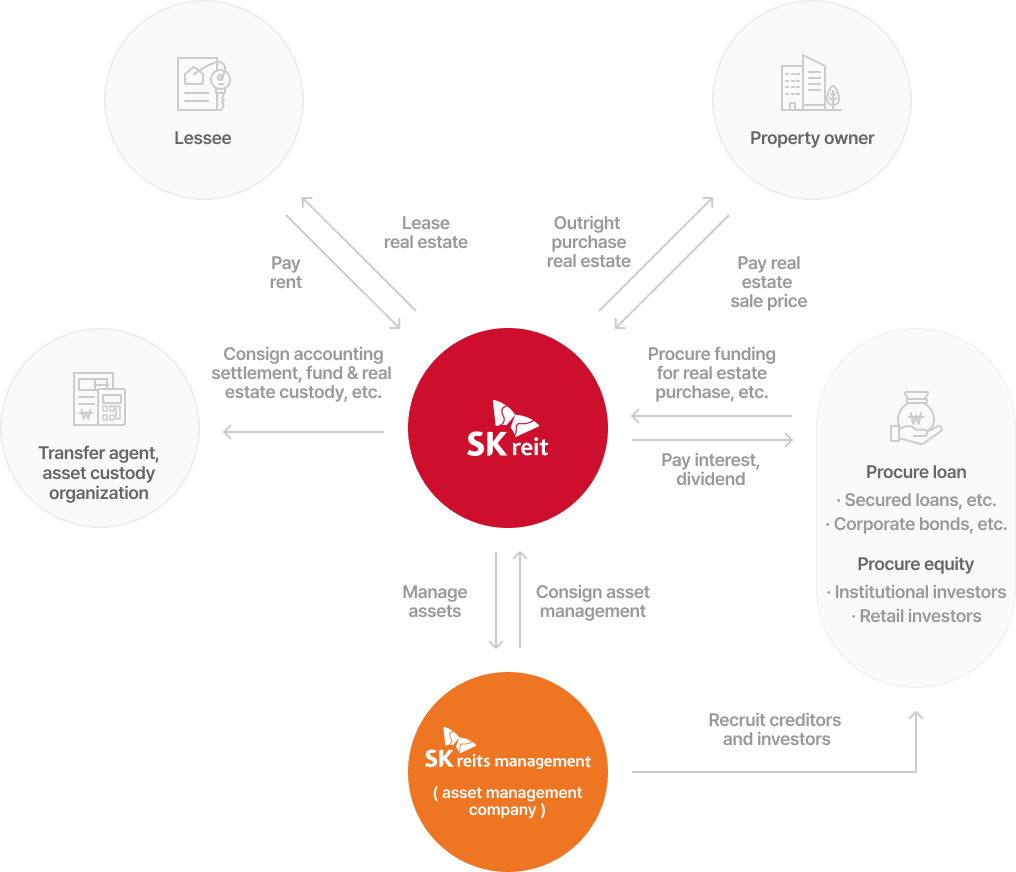

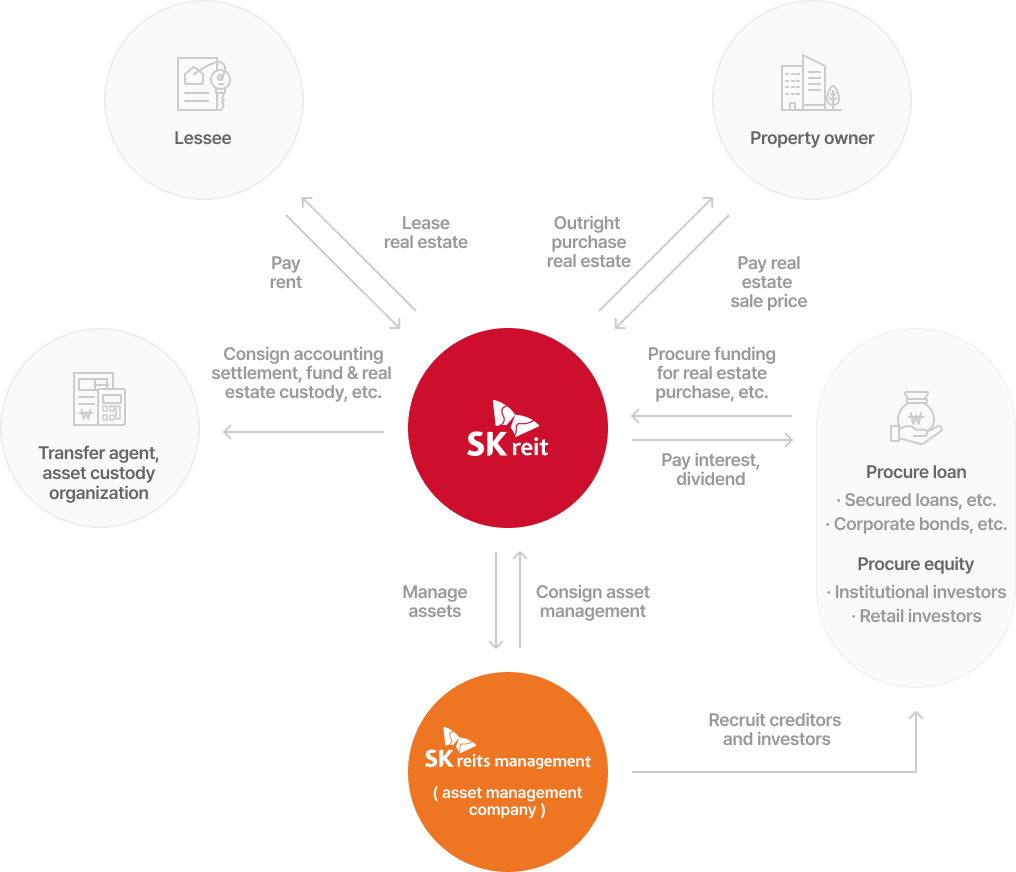

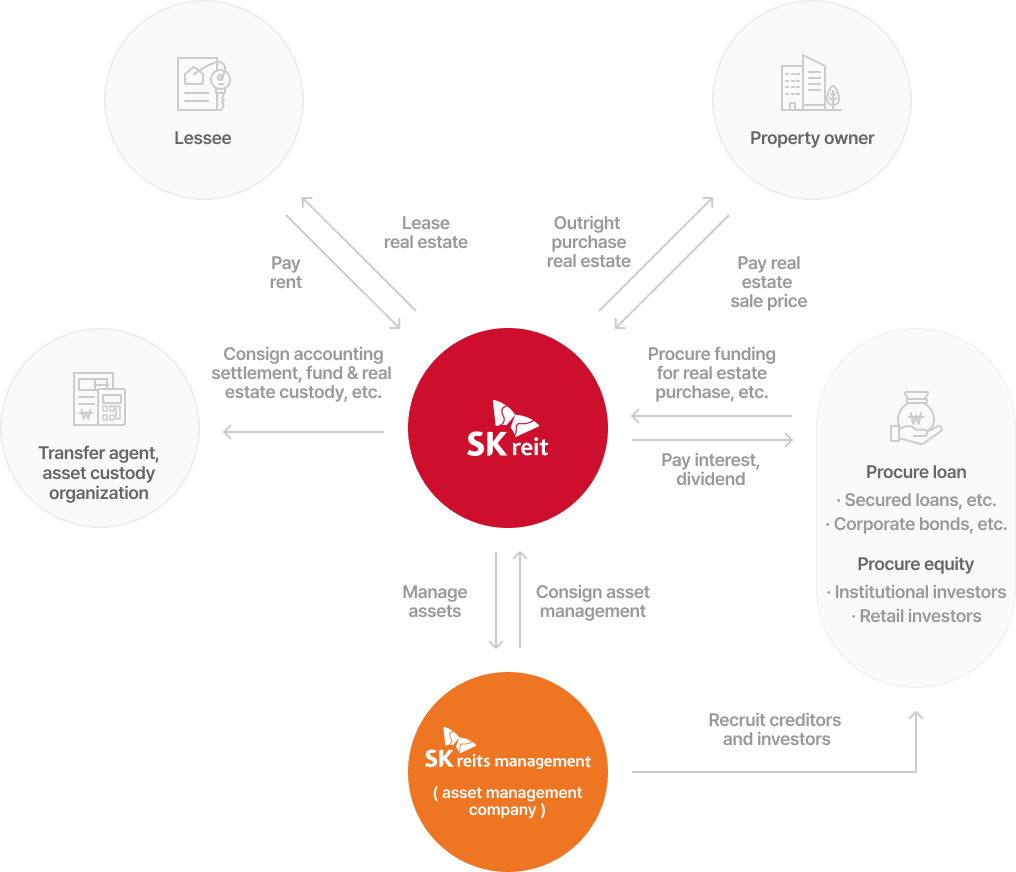

Pursuant to the Real Estate Investment Company Act, a REIT is an

incorporated indirect real estate investment

vehicle that collects funds from multiple investors in order to invest in real estate

properties, such as offices, then

returns profits from managing and selling said properties to investors in the form of dividends.

REITs are known to offer outstanding transparency in decision-making in which major management issues are decided through the Board of Directors and general shareholder meetings under the supervision of a supervising authority.

Various tax benefits, stable dividend income based on real estate rental income, and excellent liquidity are other notable advantages of REITs.

Decisions on important operational issues made through the Board of Directors

Borrowing funds, issuing bonds, approving financial

statements,

paying asset management fees, other important operational matters, etc.

Important resolutions made through general shareholder meetings

Business plans, plans to borrow funds, plans to issue bonds,

dividend payment, director remuneration, etc.

Managed and supervised by the Ministry of Land,

Infrastructure

and Transport, fulfilling of reporting and disclosure obligations

Fulfills reporting and disclosure obligations, such as investment reports and business reports, to supervising authorities and investors pursuant to the Real Estate Investment Company Act, Commercial Act, Capital Market Act, etc.

Managed and operated by expert asset managers

Workforce features skilled operators qualified pursuant to

the

Real Estate Investment Company Act.

Stable quarterly/half-yearly payment of dividends sourced from rental income

Generates a stable cash flow (e.g. rental income) using real estate properties such as offices and gas stations serving as underlying assets

Easy to buy/sell in the securities market

Investors can liquidate their holdings of a listed REITs and secure cash when necessary.

Tax breaks pursuant to the Corporate Tax Act, Local Tax Act, etc.

No corporate tax when 90% or more in distributable profit is paid out as

dividends. Listed REITs are separately taxable and are exempt from

comprehensive real estate holding tax.*

* Private REITs/funds: Property tax 0.2~0.4% Comprehensive real estate

holding tax 0.5~0.7%

REITs dividend income for retail investors separately taxable

9.9% separate taxation on dividend income paid for 3 years up to KRW 50 million invested per person

* Courtesy of Korea Association of Real Estate Investment Trusts